1) What is your income tax rate? Do you know?

-

Our own federal rate is around 16% of our Adjusted Gross Income (AGI) or 20% of taxable income. Another 4% of our state Adjusted Gross Income (5.5% of taxable income) goes directly to the state of NY. But, it doesn’t stop there, for we do own a home, and our real estate taxes represent another 10% of our state AGI. Then, there is that pesky state tax on purchases – in our county it’s at 8.75%. So although we don’t add it up most every year, it probably eats up about another 1-2% of our state AGI, depending on amount purchased each year.

- So there you are: before we know it, almost 40% of our Adjusted Goss Income is on its way to the federal and state governments! This still leaves out certain hidden taxes like about 46% federal excise tax on gasoline, the 7.5% tax on domestic flights or the hidden taxes on car rentals and hotel rooms. Then, of course, the government forces some fairly hefty hidden “sin” taxes on things they consider unhealthy for us like liquor, beer and cigarettes. The taxes on these range from 40%-45% (although not a great problem for those who don’t smoke and don’t drink beer, and just buy wine every so often!).

Now I know that not everyone has the same situation as far as income or tax liability is concerned, but, have you ever looked to see what percent of your income is actually given over to government for them to decide how it should be used? Once that money goes in you have nothing more to say about it; it gets used according to appropriations made by legislators in budget bills, and approved by the President or Governor. Department Heads in various departments of government then get to spend it in conformance with those appropriations, although they have some leeway in how to expend it, such as timely use of travel funds, for instance. Unfortunately, that’s too simplified; it’s much more complicated.

2) What happens to all that tax money?

In terms of process, your tax money goes to the IRS (and to the state’s Tax Department). Then it goes to the U.S. (or state) Treasury (much more on the process is available at https://www.nationalpriorities.org/budget-basics/federal-budget-101/federal-budget-process).

Presumably, the very first thing that happens is that checks get sent out for Social Security and tax refunds, but that’s not necessarily the way it works. Don’t forget, because of the Tax Code, there are some very strange things that happen to our tax money. Some of it never gets to where we thought it ought to go. But more on that in a moment.

The U.S. Treasury divides all spending into three groups: mandatory spending and discretionary spending and interest on debt. Interest on debt, which is much smaller than the other two categories, is the interest the government pays on its accumulated debt, minus interest income received by the government for assets it owns.

Discretionary spending refers to the portion of the budget that goes through the annual appropriations process each year. In other words, Congress directly sets the level of spending on discretionary programs. Congress can choose to increase or decrease spending on any of those programs in a given year.

Mandatory spending is largely made up of earned-benefit or entitlement programs, and the spending for those programs is determined by eligibility rules rather than the appropriations process. Congress periodically reviews the eligibility rules and may change them in order to exclude or include more people, and therefore change the amount spent on the program. Mandatory spending makes up nearly two-thirds of the total federal budget. The largest mandatory program is Social Security, which comprises more than a third of mandatory spending and around 23 percent of the total federal budget. I’m sure you know that in a rare display of bi-partisanship, the Congress just approved, and the President signed, a bill to fix the rate for doctor services at a higher level under Medicare.

On BillMoyers.com, Moyers reminds us:

“Given how much taxpayers collectively contribute to our nation’s revenue stream, it goes without saying that we should be able to influence how the government spends that money. Unfortunately, that’s not always the case. The federal government doesn’t make it easy to find out where your tax money goes.

That’s why the National Priorities Project (NPP) has done the work for you.”

Across the United States, the average taxpayer paid $11,715 in 2013 federal income taxes. The military received the largest share of that sum, $3,174, followed by health care, which received $2,662 for programs like Medicaid and the Children’s Health Insurance Program. Meanwhile, only $238 went to education programs, and just $15.84 and $6.56 went to the Low-Income Home Energy Assistance Program and National Forest System, respectively.”

However, there is something more happening than just this tidy allocation of funds. There is something known as “extraction” taking place, and too many Americans are oblivious to that process. They know nothing about it. They don’t know for instance, that the movie industry gets special treatment in the Tax Code. They are unaware that GE Corporation and several others like Grumman are getting special breaks (unknown to most of us) in order to pay little in taxes. And then there are corporations like big oil companies who are fortunate enough to get billions of dollars of our tax money as subsidies (something like “welfare” or “entitlements” for the poor and the disabled). Congress indubitably complains loudly about the latter, but is quite mute about the former.

The government gives away our tax money out of the Treasury system to subsidize certain industries that are already making huge profits on the world market. Why? Because those rich corporations control the majority of members in the Congress to the extent that they can influence legislation and regulations and procedures so that Congress protects their extraction of our money from the U.S. Treasury before it is allocated toward other benefits and services in appropriation bills. Because it is done within the Tax System, a control mechanism - like budget hearings before Congress - does not exist. There is little or no oversight; it is just extracted from our tax money and given over to these mega-corporations. Let’s take a further look.

3) Tax Breaks are Breaking the System (most of what follows is attributable to BillMoyers.com)

The federal tax code includes hundreds of tax breaks (called tax expenditures within the federal government) supposedly meant to encourage activities that lawmakers deem beneficial to society. From the perspective of the government, tax breaks are no different from any other kind of government spending. However, what it comes down to is the fact that very wealthy individuals and corporations pay less in taxes and receive subsidies as well. In both cases, the U.S. Treasury has less money, and a government activity – whether subsidies for home buying, repairs to an interstate highway, or tuition support to college students – receives less funding.

Ten of the largest tax breaks that together totaled more than $750 billion in tax savings in 2013 overwhelmingly benefited the top 1 percent of households, with 17 percent of the benefits going to those top earners. That’s in part because tax deductions — one important type of tax break — are far more likely to benefit the wealthy than middle- and low-income folks, because deductions only offer savings to taxpayers who itemize deductions. Only 16 percent of households making between $25,000 and $30,000 itemize tax deductions, while nearly 100 percent of those making over $200,000 itemize.

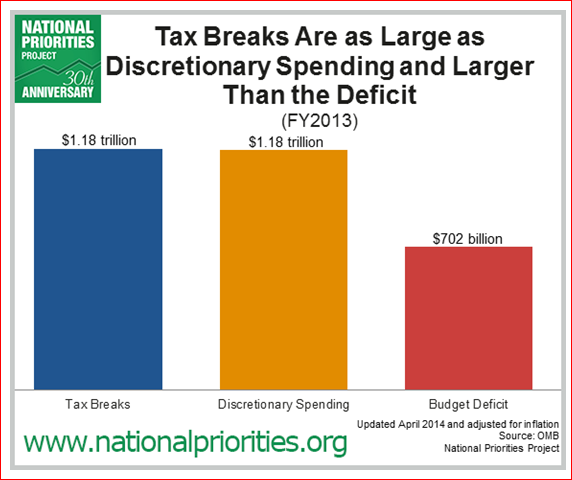

"In 2013, the cost of tax breaks was equal to the entire U.S. discretionary budget. However, the discretionary budget is subject to an annual appropriations process, where Congress debates the proposed spending. Tax breaks, on the other hand, remain on the books until lawmakers modify them. As a result, over a trillion dollars a year in lost revenue – more than 1.6 times the 2013 budget deficit – goes largely unnoticed. Take a look at this visual:

The cost of corporate tax breaks has trended upward in recent decades, totaling nearly $176 billion in fiscal 2013. In other words, the overall U.S. corporate tax bill was $176 billion lower than it would have been without the special deductions, credits, and exclusions written into our tax code. To put that in perspective, that’s about $1,328 per U.S. household,” meaning that you and I are picking up the cost of the loss of the revenue experienced from corporate tax breaks not going into discretionary programs that serve our citizens. “The largest corporate tax break allows multinational corporations to defer paying taxes on offshore profits, costing the government $65 billion in 2013 alone. That comes out to $494 per household.

“Tax breaks for individual taxpayers exceeded $1 trillion in fiscal 2013, but all individuals do not benefit equally. Major tax breaks that totaled more than $770 billion in tax savings in 2013 are tilted heavily in favor of the top income earners. According to the Congressional Budget Office, 17 percent of the benefits from major tax breaks go to the top 1 percent of households. In fact, the Tax Policy Center estimated that 4,000 taxpayers in the top 1 percent owed no income tax at all in 2013, thanks in large part to tax breaks that helped them reduce their tax liability down to zero.”

Moyers presents the following Ten Tax Breaks as examples of what happened to your tax dollars in 2013: Total $770 Billion (details available at: https://www.nationalpriorities.org/interactive-data/taxbreaks/2014/visualization/ )

CONCLUSION: Tax day is an opportunity to draw attention to some of the central budget policy choices facing our nation. How should our tax dollars be spent? Who should pay more or less in taxes? Is Congress listening to what Americans think are top spending priorities?

In February 2014, Representative David Camp (R-MI), chairman of the House Ways and Means Committee, released the “Tax Reform Act of 2014,” an over 900-page plan to overhaul the tax code. His counterpart, Senator Ron Wyden (D-OR), chairman of the Senate Finance Committee, has called for reform of the “dysfunctional, rotting mess of a carcass that we call the tax code.”

However, as we approach 2016, it’s unlikely that Congress will pass comprehensive tax reform. Instead we may see less sweeping changes, perhaps enacted as part of the budget. Sixty-seven percent of Americans want a budget that closes corporate tax loopholes and limits tax breaks for the wealthy. Here’s how the 2014 budget proposals stacked up:

The year 2015 is fairly young with just one quarter gone. What tax code legislation exists right now? “The only path to tax reform in 2015 would require a GOP Congress and Obama to call a truce on irresolvable issues such as spending and immigration and decide to do one big thing for the next two years. And that could be business tax reform.” (Howard Gleckman – taxpolicycenter.org). He admits the odds are very long against such an event taking place.

The Daily News Journal tells us that some proposals exist:

U.S. Sen. Ted Cruz of Texas, the first candidate to announce his candidacy for the Republican nomination for president in 2016, listed tax reform as a priority for the country.

"Moving towards a simple flat tax would treat all Americans more fairly and end the massive time and costs wasted in dealing with the IRS; we should let taxes become so simple that they could be filled out on a postcard. Ultimately, with a Republican president, we should abolish the IRS and end its abuse of power and violation of Americans' constitutional rights," Cruz said in a press release. Not exactly helpful, but after all -- it’s Ted Cruz!

“President Barack Obama, however, also has called for reforms in the federal tax code. In his State of the Union address in January, Obama listed several proposals he said would benefit middle-class taxpayers but cost wealthy taxpayers and financial services companies.

The president's proposals could raise $320 billion over 10 years, according to White House estimates. The president hoped to use that money to give $175 billion in tax breaks to middle-class taxpayers and to fund his $60 billion proposal to make community college free for two years. Among the proposals was a series of tax breaks for individuals, including:

- A tax credit of up to $500 for two-earner filers. Unlike deductions, which reduce your taxable income, tax credits reduce taxes dollar for dollar. The credit would be available in full for two-earner families with incomes up to $120,000, with partial credits available to those with incomes up to $210,000.

- Expand the earned-income tax credit for workers without qualifying children, increase the income level at which the credit phases out and make it available to workers 21 and older.

- Increase the child care tax credit to $3,000, and make the maximum credit available to most families with incomes up to $120,000.

- Make the American Opportunity Tax Credit permanent and give college students a tax credit of up to $2,500 a year for five years. Part-time students would be eligible for a $1,250 AOTC.

- Simplify the student loan interest tax deduction.

Observers, however, noted that the president's proposal had little chance in the Republican-controlled Congress.”

These proposals are worthy of consideration because they address some needs of the middle and lower income groups. However, they also add to or amend the Tax Code in favor of the little guy rather than correcting the code that continues to favor wealthy individuals and corporations.

Neither side seems willing to face the real issue: reform the current Code and prevent rich people and businesses from extracting our tax money for their aggrandizement, which turns out to be the largest welfare fraud ever perpetrated on the American people!

But, let’s be fair. As an editorial in the Detroit News reminds us: there’s something wrong as well with “the fact that nearly half of wage earners pay no federal income taxes. Meanwhile, the top 10 percent of earners pay 68 percent of all income taxes, and are the repeated target of the desire to raise more revenue.” If they are the investment class, “the more the government takes from them, the less they have to invest, and they will fail to put “their money to work creating jobs and economic development.” I would say that this leaves out their greed and avarice, but nonetheless, there is some truth here with which reformers must deal.

“Corporate taxes in the United States are the highest in the industrial world. And they are so complicated and include so many carve-outs, exemptions and deductions that it is nearly impossible to avoid running afoul of tax law, even with the help of competent accountants. But most businesses don’t pay corporate taxes — most owners of small businesses are taxed at the individual income tax rate and face the same disincentives to use their earnings to create more jobs.

“America needs a simpler…and fairer tax code, one that encourages savings and investment and fosters economic growth and job creation. It shouldn’t be impossible for lawmakers and the president to do what their predecessors did three decades ago and give taxpayers a meaningful overhaul of the tax code.”

So what legislation exists in 2015 as far as Tax Code reform legislation is concerned? Not very much, although proposals, tainted by political ideology and rhetoric abound. A comprehensive tax reform plan of over 900 pages that was released on February 26, 2014 from House Ways and Means Committee Chairman Dave Camp (R-Mich.), is still available even though the Chairman has retired. The “The Tax Reform Act of 2014” (the “Act”) seeks to simplify the tax code and lower rates for individuals and corporations while raising the same level of revenue. For a comprehensive summary look at its proposals, go to:

You have the opportunity to influence this process by communicating with your legislators about what you believe should be done. Are certain tax breaks important to you? Do you believe some tax breaks should be eliminated from the tax code? This is your opportunity to influence Washington. Take Action.These proposals are worthy of consideration because they address some needs of the middle and lower income groups. However, they also add to or amend the Tax Code in favor of the little guy rather than correcting the code that continues to favor wealthy individuals and corporations.

Neither side seems willing to face the real issue: reform the current Code and prevent rich people and businesses from extracting our tax money for their aggrandizement, which turns out to be the largest welfare fraud ever perpetrated on the American people!

But, let’s be fair. As an editorial in the Detroit News reminds us: there’s something wrong as well with “the fact that nearly half of wage earners pay no federal income taxes. Meanwhile, the top 10 percent of earners pay 68 percent of all income taxes, and are the repeated target of the desire to raise more revenue.” If they are the investment class, “the more the government takes from them, the less they have to invest, and they will fail to put “their money to work creating jobs and economic development.” I would say that this leaves out their greed and avarice, but nonetheless, there is some truth here with which reformers must deal.

“Corporate taxes in the United States are the highest in the industrial world. And they are so complicated and include so many carve-outs, exemptions and deductions that it is nearly impossible to avoid running afoul of tax law, even with the help of competent accountants. But most businesses don’t pay corporate taxes — most owners of small businesses are taxed at the individual income tax rate and face the same disincentives to use their earnings to create more jobs.

“America needs a simpler…and fairer tax code, one that encourages savings and investment and fosters economic growth and job creation. It shouldn’t be impossible for lawmakers and the president to do what their predecessors did three decades ago and give taxpayers a meaningful overhaul of the tax code.”

So what legislation exists in 2015 as far as Tax Code reform legislation is concerned? Not very much, although proposals, tainted by political ideology and rhetoric abound. A comprehensive tax reform plan of over 900 pages that was released on February 26, 2014 from House Ways and Means Committee Chairman Dave Camp (R-Mich.), is still available even though the Chairman has retired. The “The Tax Reform Act of 2014” (the “Act”) seeks to simplify the tax code and lower rates for individuals and corporations while raising the same level of revenue. For a comprehensive summary look at its proposals, go to:

As primary investors in our nation, we should all speak up with our own opinions on these questions. Making our priorities clear to lawmakers in Congress is a key part of making tax day something we can be proud of, even as we groan about filling out all those IRS forms!